What You Should Know

Just like other professionals, appraisers have their own dictionary. The terms are foreign to most business owners as they know their business and not the art of property valuation. In this blog, we will provide some terms that may be helpful should you decide to appeal your property taxes on your own property.

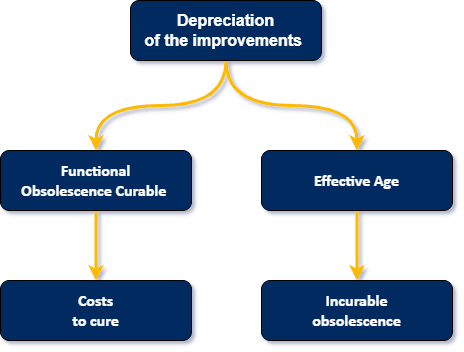

In mass appraisals, a significant number of properties are assessed using the cost approach to value. This approach values the land and determines the depreciated value of the improvements. The assessed values typically allocate their value to three components: land, buildings, and site improvements. For properties that are assessed based on this approach, the following depreciation of the improvements can be a source for a reasonable reduction in assessed values.

Functional Obsolescence Curable – This category of depreciation is for the costs needed to repair the building to a condition that provides a competitive product in the market. For example, A property owner of an apartment complex had a property where several of the units were not rentable because of damages to the roof from a storm. Several of the units had water damage and were not rentable. The assessor valued the property without consideration of the condition of the improvements. The cost estimates for the repairs were provided and the assessed value was reduced because of functional obsolescence curable. So, if your building needs repairs, then the costs to cure could represent a reasonable reduction.

Effective Age – This type of depreciation results in incurable obsolescence. The tax card will likely show the effective age under the abbreviation “EYB” or effective year built. Next to this information is the “AYB” or actual year built. If the EYB is more recent than the AYB, then this is an opportunity to reduce the assessed value of your improvements. Keep in mind that if you have renovated your building, the assessor will likely be aware of the renovations by the permits pulled for the repairs. If the condition of the building warrants, one could argue that the EYB and AYB should be the same.

There are numerous terms in the appraisal world that are not commonly used in conversation. Just like lawyers, doctors and other professions, the appraisal profession relies on the universality of the definitions of these terms and how they apply to a valuation. At SBPTA, we speak the language and can analyze the multitude of variables that result in your assessed value. If there are inconsistencies, we can communicate with the governing authority using the appropriate valuation terms and assist the assessor in correctly applying their schedule of values to your property.